We’ve done a simple and easy comparison of Accu-Trade’s Instant Offer vs TradePending’s Snap vs Mobials Tradesii and how they approach Value My Trade, Vehicle Valuations, and more!

We put these three trade-in forms to the test and dug into THREE very important questions:

1. What are they using for Data?

2. What kind of User Interface is it?

3. What makes them Different?

Let’s dive in!

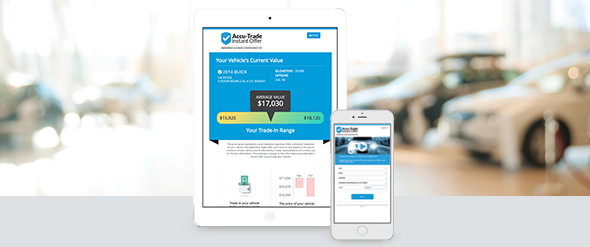

Accu-Trade Instant Offer

Data? The values are based on Galves Market Data. Galves data is NOT a mere statistic or market average. It is NOT derived from some mathematical formula projecting depreciation at a steady pace and it is NOT simply the average price paid at auction last week. Publishing meaningful trade-in values requires digging deeper than that. Galves does exactly that and offer dealers and consumers values that make sense in the real world. Values are based on:

- Analysis of current auction data by in-house staff

- Input received from experienced consultants

- Constant feedback received from dealers doing business

- 60+ years of experience evaluating and analyzing historical/seasonal trends.

UI? Accu-Trade sticks to a mobile-friendly form that converts the highest quality leads. The form prompts users for “Interested in” vehicles, allowing the dealership to get a feel for deal structure when the lead comes into the dealership. Accu-Trade attributes its form’s 48%+ completion rate to customer buy-in and a balanced approach, where they give consumers an idea of their tax savings and expected depreciation (building trust through information) before giving the consumer a instant range for their trade.

Differentiation? Accu-Trade gives dealerships the ability to tailor the values the customer sees. They recognize that not every dealership has the same trade in philosophy, or process. They put the values in the dealer’s hands by allowing them to tailor the data in three ways: using one of six “sliding scales”, by an added or deducted percentage, or by adding or subtracting a flat value from every valuation.

Dealers like Western GMC say Accu-Trade is the best lead source on the market, backed up by reports of an average increase in leads anywhere from 500-800%.

TradePending SNAP

Data? TradePending’s SNAP Market Reports use real values of local cars for sale by other franchised dealers. They have been able to source and manipulate a highly complicated and complete algorithm that captures millions of data points at a time. They actually scrape live retail data from websites across North America to provide live retail valuations for consumers on dealership websites.

UI? TradePending (out of the US) has a clean and quick Value Your Trade user experience, and was awarded the AWA Website Merchandising award this year for their overall form completion rate of 26%. Their responsive text box form integrates onto dealership websites in a visually pleasing and well blended fashion. They work with each dealership to customize color and CTAs for their customers. After the customer fills out their vehicle info they are prompted by a static form into entering their name, phone number and email address (suggested minimum fields.) TradePending also gives dealers the option to add other requirements to increase the quality of their leads.

Differentiation? TradePending claims to be the market leader when it comes to lead generation in North America stating that their form generates 200 to 300% more leads than traditional trade tools.

Mobials Tradesii

Data? Tradesii is Canadian Black Book data re-purposed into a user friendly line of text box code.

UI? Similar to TradePending, Tradesii has taken a responsive type-ahead approach. Their two-step, 10 second value my trade form gives customers a range of values for their trade with very little buy-in.

Differentiation? Tradesii has been able to leverage brand awareness associated with Canadian Black Book data, while solidifying a concrete relationship with powerhouse classifieds company Kijiji (an ebay company). I predict that their vision involves continuing to build out a customer-facing suite of products (Reviewsii, Tradesii… I’m sure we can expect more exciting additions soon) under the umbrella of their company, Mobials.

Interested in more comparison data? Check out our other Accu-Trade comparison blogs to find out more about how we stack up against the competition.

Contact Logan at logan@accu-trade.ca or call her at 506-874-7355 for ways to attract more in-market buyers.